ISO health insurance meets your

university requirements. Guaranteed.

ISO – Health insurance for international students, by international students

We know international students

Established in 1958 by international students, ISO is the world’s largest insurance manager solely for international students.

We’ve got you covered

ISO covers you anywhere in the USA and worldwide with access to over one million doctors. A complete worry-free process!

Excellent service is our specialty

Our multilingual team provides the best customer service. Instant insurance documents upon enrollment and an easy claims process.

Insurance that meets your needs

Our plans are affordable, comprehensive, and meet your school’s requirements. Waiver approval guaranteed!

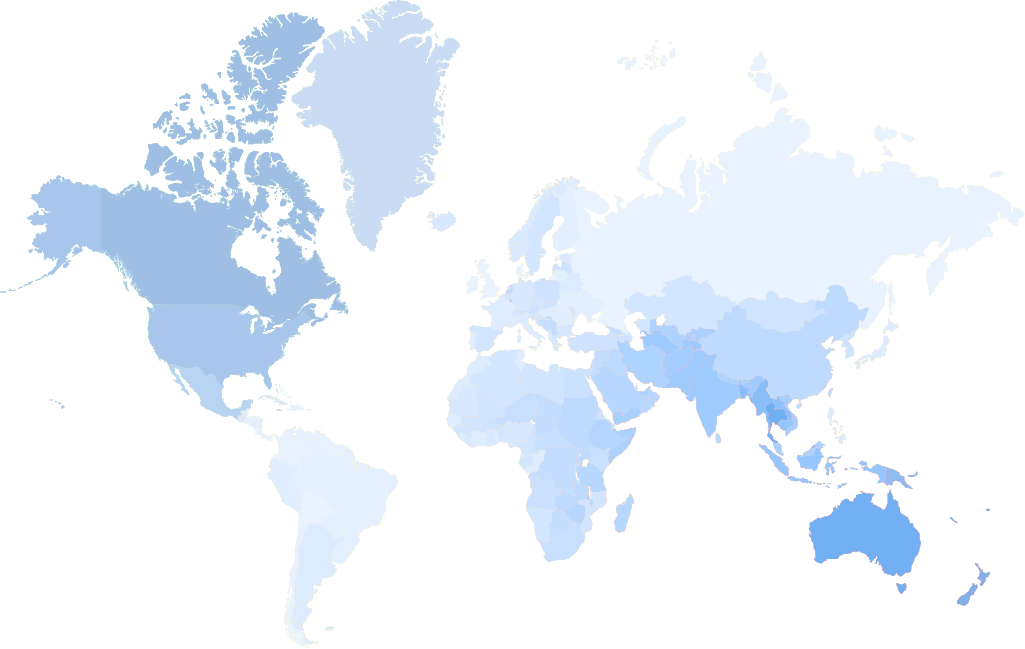

First choice for students

from over 185 countries

ISO Student Health Insurance

ISO is trusted by

millions of students

Find insurance plans

Read ISO blog for information and tips

.png)

How to Enroll in the New York Essential Plan

.png)

Five Reasons to Avoid the Emergency Room in the U.S.

Any Questions?

We Are Here to Help

Additional FAQ

ISO is the world's largest international student insurance manager. We offer dedicated health insurance plans for F1 visa international students, J1 visa scholars and students, F1-OPT holders and F2/J2 dependents. As long as you are in the U.S. on a valid visa, ISO has a plan for you.

ISO stands for International Student Organization, the world’s largest international student insurance manager. ISO has been offering affordable insurance plans since 1958 and will always be for international students, by international students.

ISO insurance plans are designed to meet the specific needs of your school’s waiver requirements or visa status at an affordable rate. Guaranteed!

University advisor & administrator or insurance broker?

Please enter to view and manage your insurance plan brochures and rosters