Understanding Your Explanation of Benefits

ISO Customer Care | Nov 17, 2023 Insurance

The general claims process

A claim is a request for payment that you or your healthcare provider will submit to your health insurance when you incur medical expenses.

After any visit to the doctor or hospital, a claim is filed so that insurance can process to see how much is eligible for coverage, and how much may be patient’s responsibility.

Once the claim is processed, you and the medical provider will be issued an Explanation of Benefits by mail. It is also always available electronically in your ISO portal.

How to find and read your EOB – steps to see the breakdown of your charges

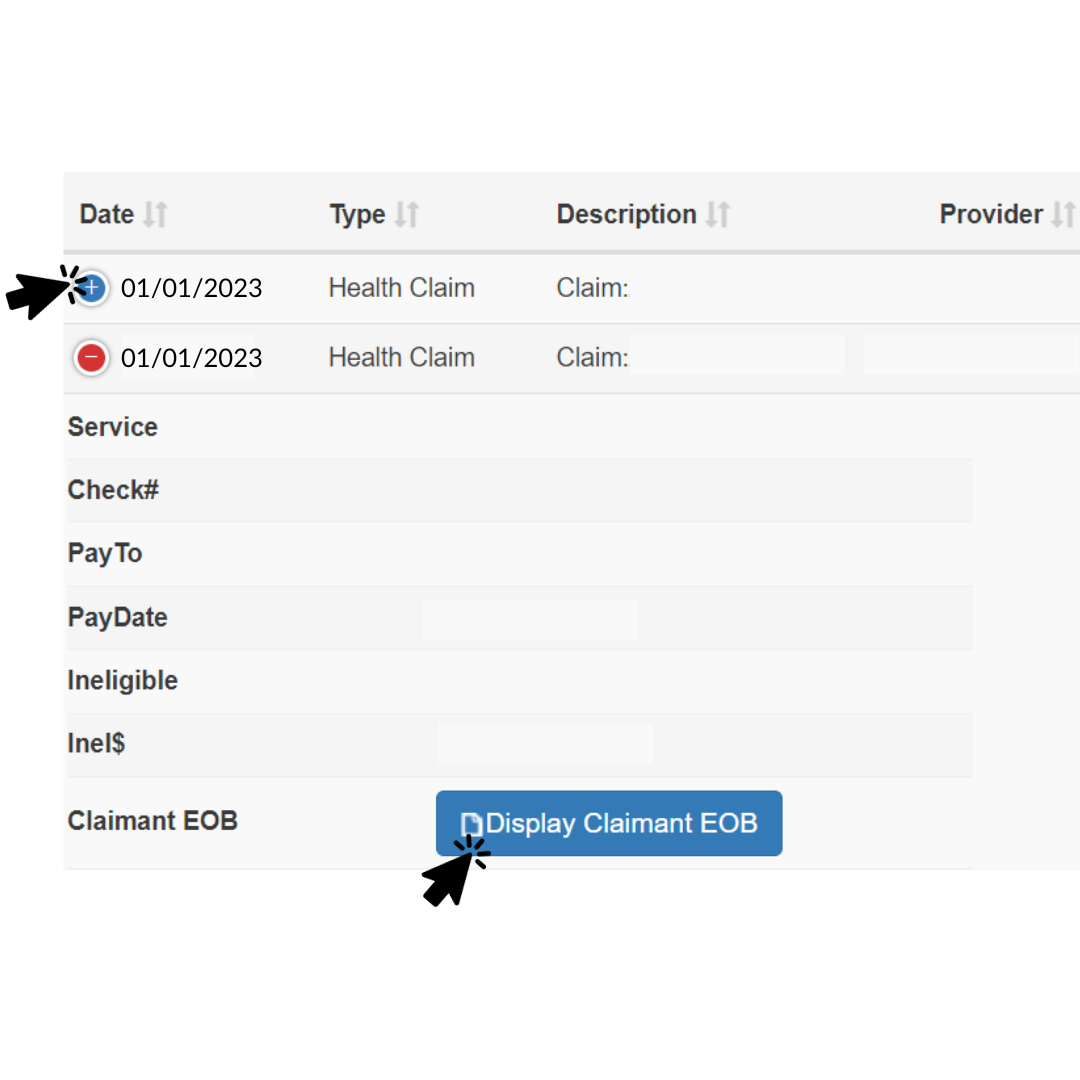

ISO members can login to their account, go to “My claims” to view status updates and their digital EOBs. In the portal, just click on the blue ‘+’ sign, and click “Display Claimant EOB.” You will then see the image below. is a request for payment that you or your healthcare provider will submit to your health insurance when you incur medical expenses.

For a more detailed explanation of the claims process, review our blog post here .

What is an EOB?

An explanation of benefits (EOB) is the insurance company’s written explanation regarding a claim, showing what they paid and what the patient must pay.

The EOB is not a bill. It explains how insurance processed medical charges, how much the patient may owe, and how much was paid to the medical provider. This document also serves as communication to the patient if additional information is needed to have the claim processed.

If you have a claim where you already submitted payment for the services and require a reimbursement, a physical check will be included with the EOB and mailed to the patient’s address.

When will you receive an EOB?

EOBs are issued after claims are completed or if additional information is needed.

As mentioned before, a physical one will be mailed to the patient’s address on file, so it is extremely important to have updated and accurate address information. You can also access your EOB by logging into your ISO Account.

How to understand your EOB

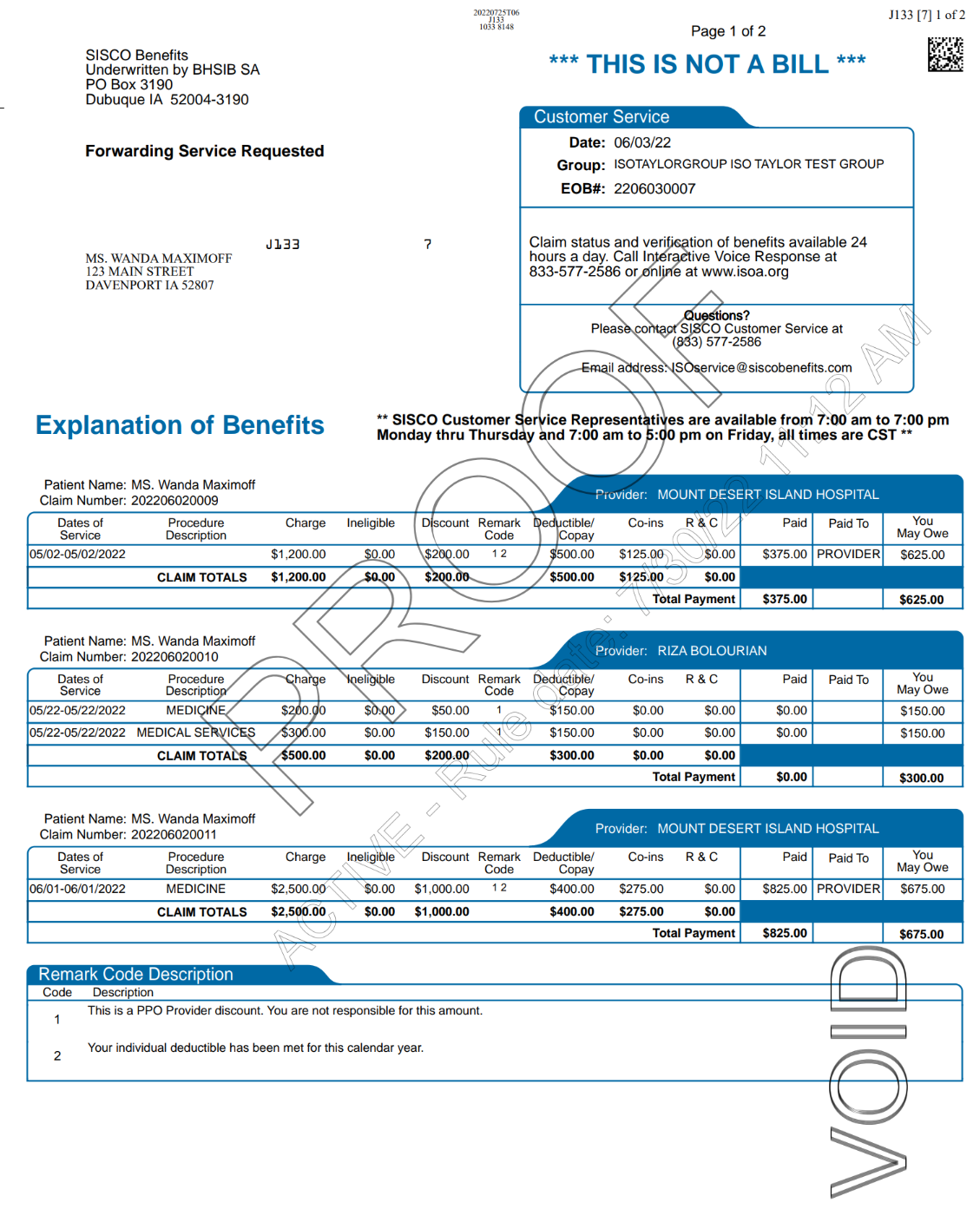

*Please refer to the EOB found below

- Dates of service: The date you visited the provider or received the service.

- Procedure code: Also known as CPT code, for each service you received during the visit. For example, 99214 is for office visits, or 80047 may be for blood tests. This is used between medical providers and insurance companies for billing purposes.

- Charge: The amount initially billed by your medical provider, before insurance processes

- Ineligible: An amount that insurance determined will not be eligible for coverage.

- Discount: Received for going to an in-network provider (with ISO members, this is with Aetna).

- Remark code: The reason why the service was listed as ineligible, discounted, or if additional information is needed. You can view the “Remark Code” section in the EOB for more information.

- Deductible: Amount that was applied to the deductible after PPO discount (if applied)

- Copay: Amount that is applied to copay after PPO discount (if applied)

- Co-ins: Short for “co-insurance”. Amount you are responsible for after copay/deductible according to your plan

- R&C: Reasonable and customary, meaning the amount normally charged by medical service provider for similar services and supplies in your zip code area

- Paid: Amount paid by insurance

- Paid at: Percentage amount insurance paid

- Paid to: : Amount paid to the medical provider (it will say PROVIDER), or paid to (reimbursed) to member (it will state MEMBER)

- *If there is a total payment amount under Paid, and the Paid to column states “Member”, then you should also find a reimbursement check on the same EOB document.*

- You may owe: What you owe after insurance has paid for everything else. Payment for this portion should go directly to your provider’s office, not to ISO or SISCO Benefits. Expect to receive a bill from your doctor’s office for the amount listed here. If the amounts do not match, you should contact your provider for more information.

Remark codes you should pay attention to:

On occasions, the information submitted with the claim may not be sufficient to allow the claims department to process the payment. You may see one of the following listings in the remark code if additional information is needed, stating: Claim has been closed due to no response to our request for:

- Accident information

- Pre-existing information

- Visa eligibility information

In these cases, you must fill out the relevant form and send it back to SISCO Benefits at ISOservice@siscobenefits.com. All forms can be found here.

In addition, you may see a remark code when a PPO discount is applied towards an expense. A note will be left in the “Remarks” section to note you do not have to pay the amount listed under “Discount”. They’ll show as either:

- This is a PPO Provider discount. You are not responsible for this amount.

If you have met the deductible, you’ll see the following:

- Your individual deductible has been met for this contract period.

For services that are not eligible for coverage:

- This is not a covered expense under your plan.

Understanding how to read your EOB is extremely helpful, so you can understand the reasons and calculations of how the claims were processed.

Example of an EOB

A total of 3 services are on this EOB for different dates. For the first service on 05/02/2022, the total charge was $1,200.

Member received an in-network discount of $200 because member saw a doctor within the Aetna PPO network. Member does not pay this amount, as explained by remark code 1.

Out of that remaining amount $1,000 ($1,200 - $200), $500 went to meet the deductible. Remark code 2 shows that the deductible for the policy year has been met.

From the remaining $500, insurance covered up to 75% (which is $375), and paid to the provider. The remaining 25% of $125 is member’s responsibility.

Therefore, deductible ($500) and the remaining 25% ($125), totaling to $625 is what member pays.

Similar calculation process follows for the other two dates of service.

Example of an EOB with check reimbursement

If you are eligible for a reimbursement check, it can be found at the bottom of your EOB, which you can cash by using your mobile bank’s app.

The issue date is when the check was mailed out. Please check your mail box to receive it.

About ISO Student Health Insurance

Founded in 1958, ISO prides itself on being the leader in providing international students with affordable insurance plans. Administered by former and current international students, we are able to assist our member with multilingual customer service in Chinese, Hindi, Spanish, and more. ISO serves over 3,200 schools/colleges and more than 150,000 insured students every year.

For more information, please visit www.isoa.org and connect with us on Facebook, Instagram, WeChat, WhatsApp, and LinkedIn.

.png)

.jpg)

.jpg)